Auditrol, an intelligent control and risk management solution for financial institutions, delivers clarity, confidence, and control. Because in a world of constant regulatory change and increasingly agentic future, control is the speed!

CORE:

The Foundation of Modern Risk Governance

Powered by proprietary AI, Auditrol is the CORE (Compliance Operations & Risk Evaluation) platform powering your risk and compliance infrastructure.

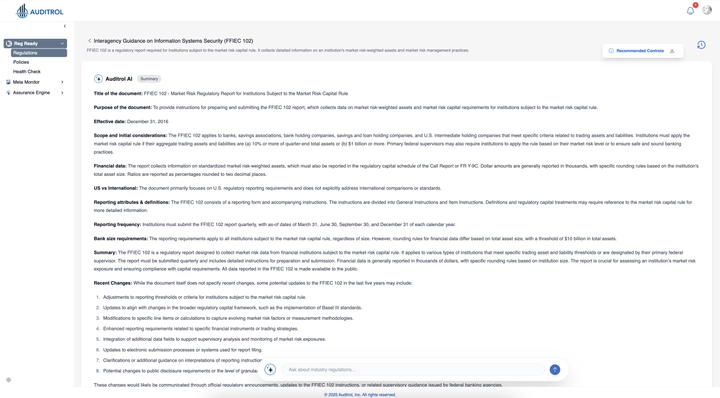

Reg Ready

Tailored Regulations by Asset Size & Identify Policy Risks

Meta Monitor

Centralize & Track Changes in Data

Assurance Engine

Identify Risks with Continuous Monitoring

Data Readiness Assessment For AI Adoption

Speed up secure, scalable AI adoption by evaluating your data governance & controls.

SOC II

SAAS

HYBRID CLOUD

MODULAR BY DESIGN

Transparent, Robust Control Mapping Tied Directly to Your Data

The need to respond to increased scrutiny by investing in effective data controls is represented in these figures for the last 24 months

-

30%

Data Control Deficiency in Regulatory Findings

-

20%

Regulatory Notices Related to MRA, MRIA & MRBA

-

$3B +

Fines Related to Non-Compliance of Technology Controls

With over 100+ integrations,

Auditrol connects seamlessly to your

databases, applications,

and workflow tools turning static data into actionable, audit-ready outcomes.

Plan Strategically. Govern Proactively.

Cut control implementations from years... to weeks

achieve traceability from regulations to data & business processes

With risk readiness and business agility built into Auditrol, risk and compliance leaders have a scalable system designed for the demands of today and ready for tomorrow. It's not just another platform. It's the foundation of modern risk governance!

Discover What's Possible

Take control of your risk and compliance future and start transforming risk management into a strategic advantage.

Request a Demo